section 179 deduction 2024 vehicle list – Below is our annual guide to Tax Code Section 179 for self-employed options can keep a vehicle from qualifying, so do your homework! IMPORTANT: This is the list of 2023 models that qualify, . you need to prorate the deduction. If you happened to purchase the vehicle in a prior year and want to claim the Section 179 deduction, unfortunately, that is not permissible. To qualify for the .

section 179 deduction 2024 vehicle list

Source : www.blockadvisors.com

Maserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

Source : www.joerizzamaserati.com

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

Section 179 Eligible Vehicles at Bob Moore Auto Group

Source : www.bobmoore.com

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

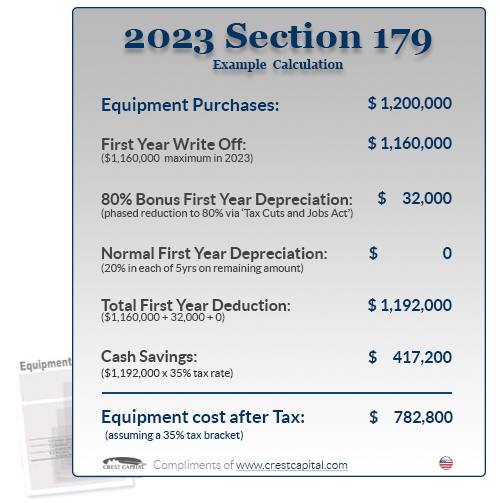

Section 179 Tax Deduction for 2023 | Section179Org

Source : www.section179.org

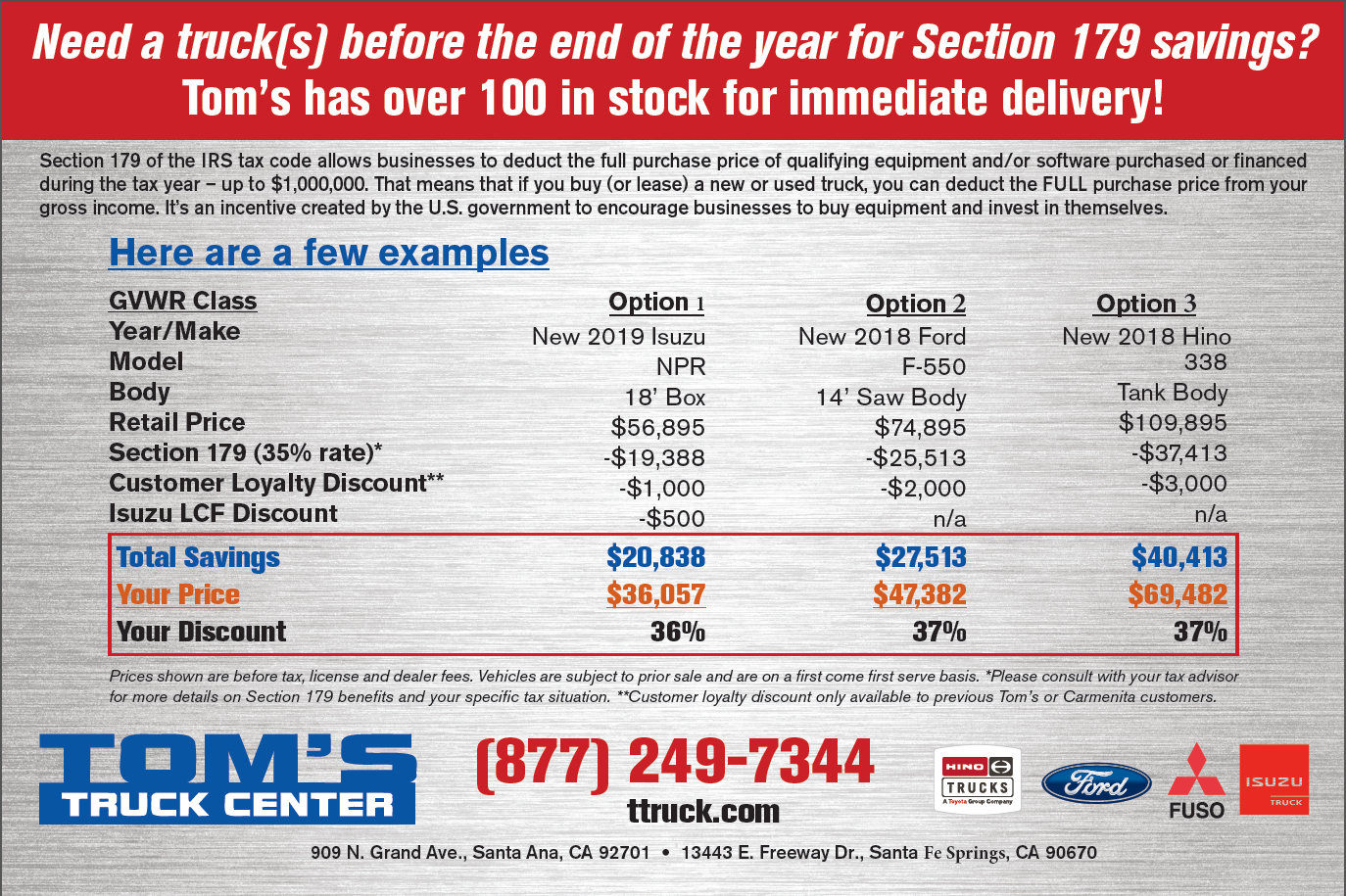

Section 179 Deductions! | Tom’s Truck Center

Source : www.ttruck.com

Maserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

Source : www.joerizzamaserati.com

UPDATES] Section 179 Deduction Vehicle List 2023

Source : www.xoatax.com

BEST Vehicle Tax Deduction 2023 (it’s not Section 179 Deduction

Source : www.youtube.com

section 179 deduction 2024 vehicle list Section 179 Deduction List for Vehicles in 2023 | Block Advisors: Section 179 is one of the more misunderstood parts of the US tax code. While many companies take advantage of the tax deduction for equipment purchases, a surprising number of US businesses do not. . Adding medical insurance to the investment portfolio not only provides health coverage but also allows an individual to avail themselves of tax benefits according to Section 80D of the Income Tax Act, .

More Stories

Nyc Schools Calendar 2024 25

Uga Schedule 2024 Football

Summer Nationals Fencing 2024